springfield mo sales tax calculator

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Springfield MO. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

Sales Tax On Grocery Items Taxjar

If you have a paid tax receipt but the vehicle is not listed.

. Real property tax on median home. Review the sales tax benchmarks. Skip to Main Content.

Sales Tax State Local Sales Tax on Food. The current total local sales tax rate in Springfield MO is 8100. Sales Tax State Local Sales Tax on Food.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local. 840 Boonville Avenue Springfield MO 65802 Phone. We are located at 212 w kearney st springfield mo 65803.

The current state sales tax on car purchases in Missouri is a flat rate of 4225. The minimum combined 2022 sales tax rate for Springfield Missouri is. RE trans fee on.

417-864-1000 Email Us Emergency Numbers. The December 2020 total local sales tax rate was also 8100. What is the sales tax rate in Springfield Missouri.

65801 65803 65804 65805. Find Sales and Use Tax Rates Enter your street address and city or zip code to view the sales and use tax rate information for your address. Indicates required field.

Use this calculator to figure out the combined rate 8 digits. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit. That means if you purchase a vehicle in Missouri you will have to pay a minimum of 4225.

You can find more tax rates. Home Motor Vehicle Sales Tax Calculator. Just enter the five-digit zip code.

And instantly calculate sales taxes in every state. Real property tax on median home. Sales Tax State Local Sales Tax on Food.

Springfield in Missouri has a tax rate of 76 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Springfield totaling 337. Real property tax on median home. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

The Springfield Missouri sales tax rate of 81 applies to the following fourteen zip codes. Sales Tax State Local Sales Tax on Food. This is the total of state county and city sales tax rates.

The Springfield Missouri Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Springfield Missouri in the USA using average Sales Tax Rates andor. Real property tax on median home.

Vermont Property Tax Calculator Smartasset

Fairfax County Va Property Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

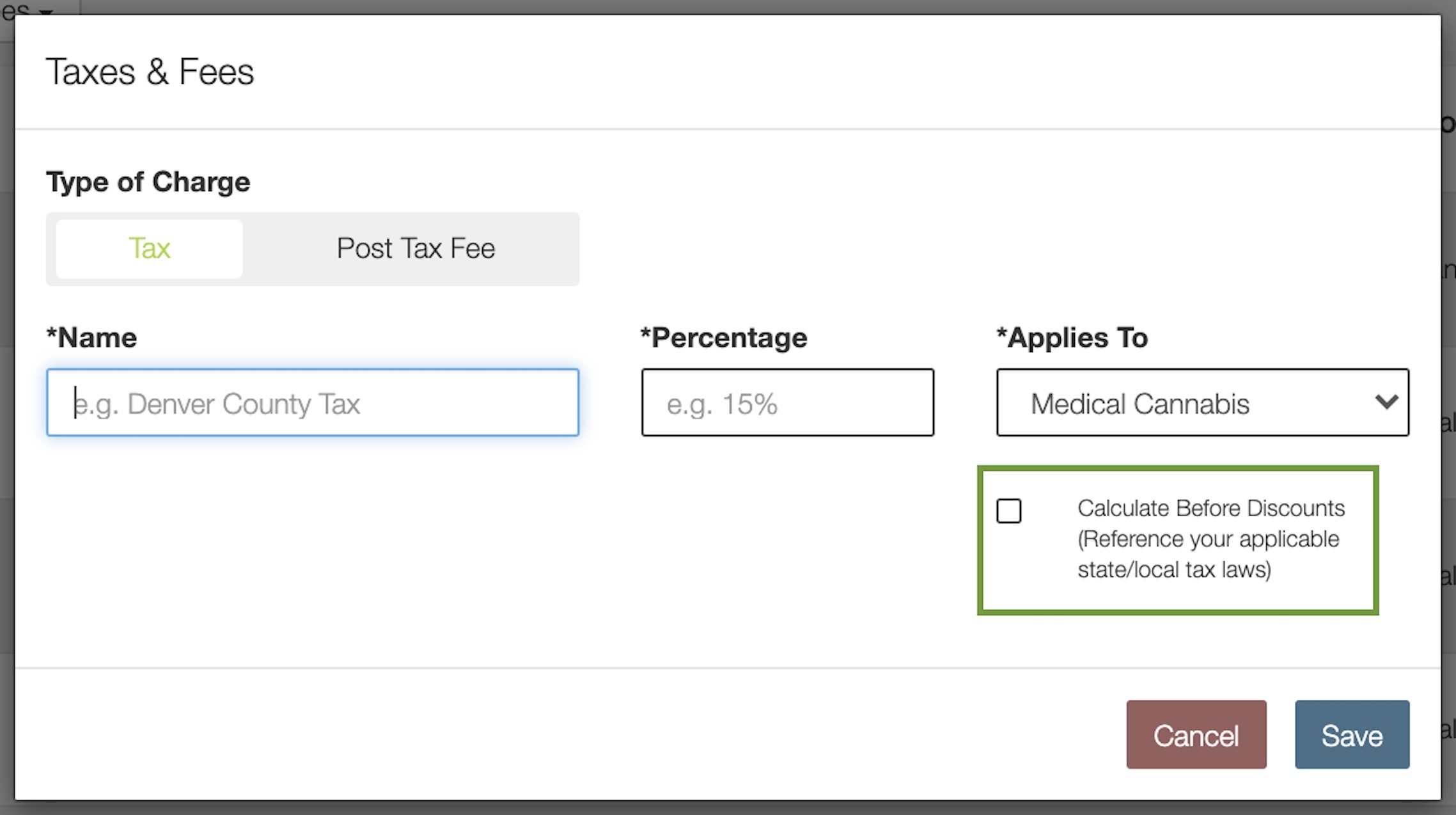

How To Calculate Cannabis Taxes At Your Dispensary

Missouri Sales Tax Small Business Guide Truic

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Sales Tax Video Lesson Transcript Study Com

Sales Taxes In The United States Wikiwand

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Calculate Cannabis Taxes At Your Dispensary

Missouri Car Sales Tax Calculator

Missouri Income Tax Rate And Brackets H R Block